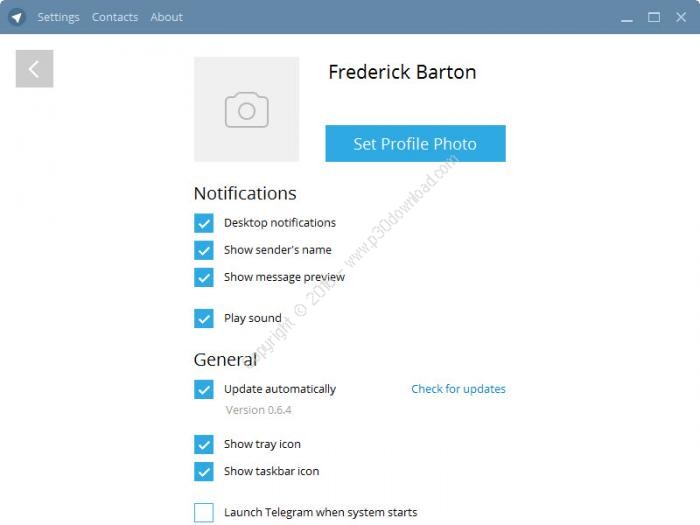

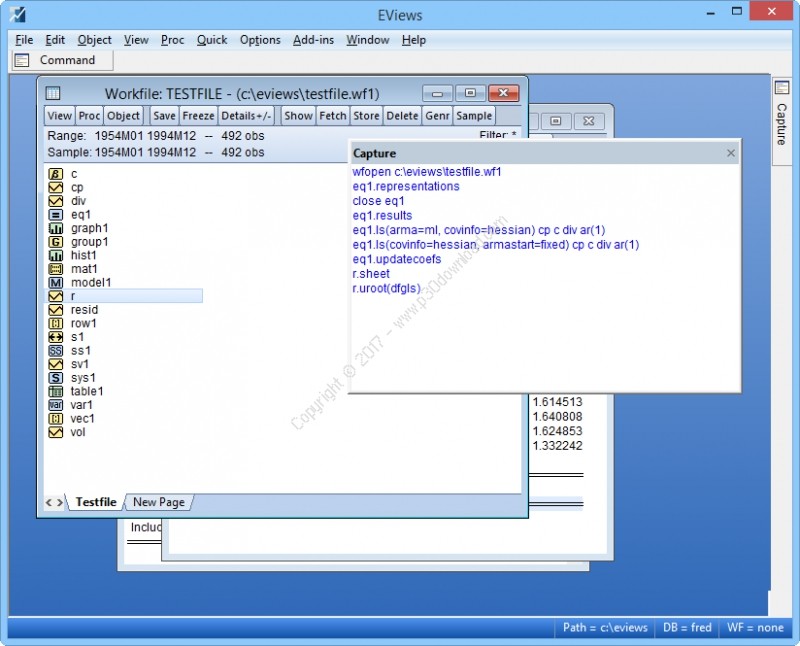

Software Description: EViews v10.0 Build October 19, 2017 x86/x64 Keygen Crack

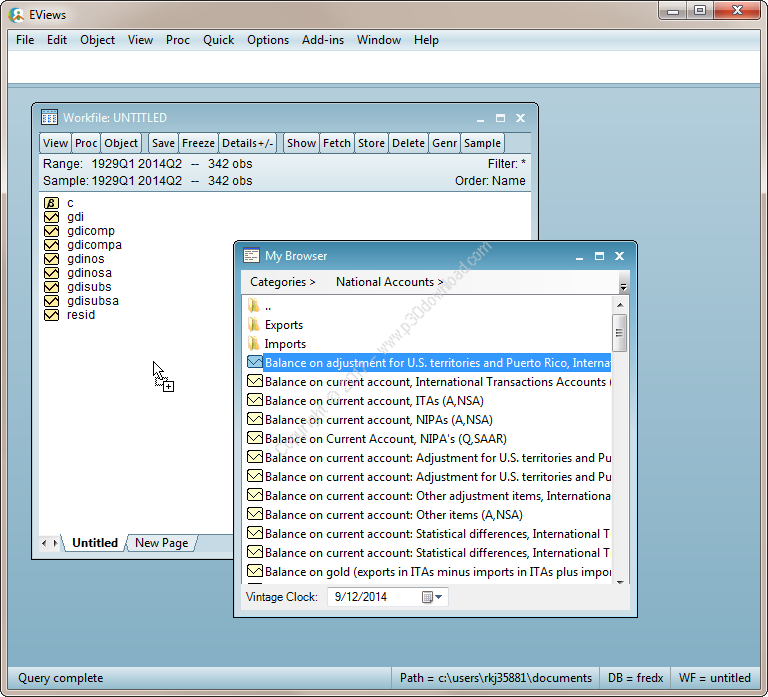

A combination of power and ease-of-use makeEViews the ideal package for anyone working withtime series, cross-section, or longitudinal data. With EViews, youcan quickly and efficiently manage your data, perform econometricand statistical analysis, generate forecasts or model simulations,and produce high quality graphs and tables for publication orinclusion in other applications.

Featuring an innovative graphical object-oriented user-interfaceand a sophisticated analysis engine, EViews blends the best ofmodern software technology with the features you’ve always wanted.The result is a state-of-the art program that offers unprecedentedpower within a flexible, easy-to-use interface.

EViews offers a extensive array of powerful features for datahandling, statistics and econometric analysis, forecasting andsimulation, data presentation, and programming. While we can’tpossibly list everything, the following list offers a glimpse atthe important EViews features:

Basic Data Handling:

– Numeric, alphanumeric (string), and date series; valuelabels.

– Extensive library of operators and statistical, mathematical,date and string functions.

– Powerful language for expression handling and transformingexisting data using operators and functions.

– Samples and sample objects facilitate processing on subsets ofdata.

– Support for complex data structures including regular dated data,irregular dated data, cross-section data with observationidentifiers, dated, and undated panel data.

– Multi-page workfiles.

– EViews native, disk-based databases provide powerful queryfeatures and integration with EViews workfiles.

– Convert data between EViews and various spreadsheet, statistical,and database formats, including (but not limited to): MicrosoftAccess® and Excel® files (including .XSLX and .XLSM), Gauss

– Dataset files, SAS® Transport files, SPSS native and portablefiles, Stata

– files, Tableau®, raw formatted ASCII text or binary files, HTML,or ODBC databases

– and queries (ODBC support is provided only in the EnterpriseEdition).

– OLE support for linking EViews output, including tables andgraphs, to other packages, including Microsoft Excel®, Word® andPowerpoint®.

– OLEDB support for reading EViews workfiles and databases usingOLEDB-aware clients or custom programs.

– Support for FRED® (Federal Reserve Economic Data), World Bank,and EuroStat databases. Enterprise Edition support for GlobalInsight DRIPro and DRIBase, Haver Analytics® DLX®, FAME, EcoWin,Bloomberg®, EIA®, CEIC®, Datastream®, FactSet®, and Moody’sEconomy.com databases.

– The EViews Microsoft Excel® Add-in allows you to link or importdata from EViews workfiles and databases from within Excel.

– Drag-and-drop support for reading data; simply drop files intoEViews for automatic conversion and linking of foreign data andmetadata into EViews workfile format.

– Powerful tools for creating new workfile pages from values anddates in existing series.

– Match merge, join, append, subset, resize, sort, and reshape(stack and unstack) workfiles.

– Easy-to-use automatic frequency conversion when copying orlinking data between pages of different frequency.

– Frequency conversion and match merging support dynamic updatingwhenever underlying data change.

– Auto-updating formula series that are automatically recalculatedwhenever underlying data change.

– Easy-to-use frequency conversion: simply copy or link databetween pages of different frequency.

– Tools for resampling and random number generation for simulation.Random number generation for 18 different distribution functionsusing three different random number generators.

– Support for cloud drive access, allowing you to open and savefile directly to Dropbox, OneDrive, Google Drive and Boxaccounts.

Time Series Data Handling:

– Integrated support for handling dates and time series data (bothregular and irregular).

– Support for common regular frequency data (Annual, Semi-annual,Quarterly, Monthly, Bimonthly, Fortnight, Ten-day, Weekly, Daily -5 day week, Daily – 7 day week).

– Support for high-frequency (intraday) data, allowing for hours,minutes, and seconds frequencies. In addition, there are a numberof less commonly encountered regular frequencies, includingMulti-year, Bimonthly, Fortnight, Ten-Day, and Daily with anarbitrary range of days of the week.

– Specialized time series functions and operators: lags,differences, log-differences, moving averages, etc.

– Frequency conversion: various high-to-low and low-to-highmethods.

– Exponential smoothing: single, double, Holt-Winters, and ETSsmoothing.

– Built-in tools for whitening regression.

– Hodrick-Prescott filtering.

– Band-pass (frequency) filtering: Baxter-King,Christiano-Fitzgerald fixed length and full sample asymmetricfilters.

– Seasonal adjustment: Census X-13, STL Decomposition, MoveReg,X-12-ARIMA, Tramo/Seats, moving average.

– Interpolation to fill in missing values within a series: Linear,Log-Linear, Catmull-Rom Spline, Cardinal Spline.

Statistics

Basic:

– Basic data summaries; by-group summaries.

– Tests of equality: t-tests, ANOVA (balanced and unbalanced, withor without heteroskedastic variances.), Wilcoxon, Mann-Whitney,Median Chi-square, Kruskal-Wallis, van der Waerden, F-test,Siegel-Tukey, Bartlett, Levene, Brown-Forsythe.

– One-way tabulation; cross-tabulation with measures of association(Phi Coefficient, Cramer’s V, Contingency Coefficient) andindependence testing (Pearson Chi-Square, Likelihood RatioG^2).

– Covariance and correlation analysis including Pearson, Spearmanrank-order, Kendall’s tau-a and tau-b and partial analysis.

– Principal components analysis including scree plots, biplots andloading plots, and weighted component score calculations.

– Factor analysis allowing computation of measures of association(including covariance and correlation), uniqueness estimates,factor loading estimates and factor scores, as well as performingestimation diagnostics and factor rotation using one of over 30different orthogonal and oblique methods.

– Empirical Distribution Function (EDF) Tests for the Normal,Exponential, Extreme value, Logistic, Chi-square, Weibull, or Gammadistributions (Kolmogorov-Smirnov, Lilliefors, Cramer-von Mises,Anderson-Darling, Watson).

– Histograms, Frequency Polygons, Edge Frequency Polygons, AverageShifted Histograms, CDF-survivor-quantile, Quantile-Quantile,kernel density, fitted theoretical distributions, boxplots.

– Scatterplots with parametric and non-parametric regression lines(LOWESS, local polynomial), kernel regression (Nadaraya-Watson,local linear, local polynomial)., or confidence ellipses.

Time Series:

– Autocorrelation, partial autocorrelation, cross-correlation,Q-statistics.

– Granger causality tests, including panel Granger causality.

– Unit root tests: Augmented Dickey-Fuller, GLS transformedDickey-Fuller, Phillips-Perron, KPSS, Eliot-Richardson-Stock PointOptimal, Ng-Perron, as well as tests for unit roots withbreakpoints.

– Cointegration tests: Johansen, Engle-Granger, Phillips-Ouliaris,Park added variables, and Hansen stability.

– Independence tests: Brock, Dechert, Scheinkman and LeBaron

– Variance ratio tests: Lo and MacKinlay, Kim wild bootstrap,Wright’s rank, rank-score and sign-tests. Wald and multiplecomparison variance ratio tests (Richardson and Smith, Chow andDenning).

– Long-run variance and covariance calculation: symmetric or orone-sided long-run covariances using nonparametric kernel(Newey-West 1987, Andrews 1991), parametric VARHAC (Den Haan andLevin 1997), and prewhitened kernel (Andrews and Monahan 1992)methods. In addition, EViews supports Andrews (1991) and Newey-West(1994) automatic bandwidth selection methods for kernel estimators,and information criteria based lag length selection methods forVARHAC and prewhitening estimation.

Panel and Pool:

– By-group and by-period statistics and testing.

– Unit root tests: Levin-Lin-Chu, Breitung, Im-Pesaran-Shin,Fisher, Hadri.

– Cointegration tests: Pedroni, Kao, Maddala and Wu.

– Panel within series covariances and principal components.

– Dumitrescu-Hurlin (2012) panel causality tests.

– Cross-section dependence tests.

Estimation

Regression:

– Linear and nonlinear ordinary least squares (multipleregression).

– Linear regression with PDLs on any number of independentvariables.

– Robust regression.

– Analytic derivatives for nonlinear estimation.

– Weighted least squares.

– White and other heteroskedasticity consistent, and Newey-Westrobust standard errors. HAC standard errors may be computed usingnonparametric kernel, parametric VARHAC, and prewhitened kernelmethods, and allow for Andrews and Newey-West automatic bandwidthselection methods for kernel estimators, and information criteriabased lag length selection methods for VARHAC and prewhiteningestimation.

– Clustered standard errors.

– Linear quantile regression and least absolute deviations (LAD),including both Huber’s Sandwich and bootstrapping covariancecalculations.

– Stepwise regression with seven different selectionprocedures.

– Threshold regression including TAR and SETAR, and smooththreshold regression including STAR.

– ARDL estimation, including the Bounds Test approach tocointegration.

ARMA and ARMAX:

– Linear models with autoregressive moving average, seasonalautoregressive, and seasonal moving average errors.

– Nonlinear models with AR and SAR specifications.

– Estimation using the backcasting method of Box and Jenkins,conditional least squares, ML or GLS.

– Fractionally integrated ARFIMA models.

Instrumental Variables and GMM:

– Linear and nonlinear two-stage least squares/instrumentalvariables (2SLS/IV) and Generalized Method of Moments (GMM)estimation.

– Linear and nonlinear 2SLS/IV estimation with AR and SARerrors.

– Limited Information Maximum Likelihood (LIML) and K-classestimation.

– Wide range of GMM weighting matrix specifications (White, HAC,User-provided) with control over weight matrix iteration.

– GMM estimation options include continuously updating estimation(CUE), and a host of new standard error options, includingWindmeijer standard errors.

– IV/GMM specific diagnostics include Instrument OrthogonalityTest, a Regressor Endogeneity Test, a Weak Instrument Test, and aGMM specific breakpoint test.

ARCH/GARCH:

– GARCH(p,q), EGARCH, TARCH, Component GARCH, Power ARCH,Integrated GARCH.

– The linear or nonlinear mean equation may include ARCH and ARMAterms; both the mean and variance equations allow for exogenousvariables.

– Normal, Student’s t, and Generalized Error Distributions.

– Bollerslev-Wooldridge robust standard errors.

– In- and out-of sample forecasts of the conditional variance andmean, and permanent components.

Limited Dependent Variable Models:

– Binary Logit, Probit, and Gompit (Extreme Value).

– Ordered Logit, Probit, and Gompit (Extreme Value).

– Censored and truncated models with normal, logistic, and extremevalue errors (Tobit, etc.).

– Count models with Poisson, negative binomial, and quasi-maximumlikelihood (QML) specifications.

– Heckman Selection models.

– Huber/White robust standard errors.

– Count models support generalized linear model or QML standarderrors.

– Hosmer-Lemeshow and Andrews Goodness-of-Fit testing for binarymodels.

– Easily save results (including generalized residuals andgradients) to new EViews objects for further analysis.

– General GLM estimation engine may be used to estimate several ofthese models, with the option to include robust covariances.

Panel Data/Pooled Time Series, Cross-Sectional Data:

– Linear and nonlinear estimation with additive cross-section andperiod fixed or random effects.

– Choice of quadratic unbiased estimators (QUEs) for componentvariances in random effects models: Swamy-Arora, Wallace-Hussain,Wansbeek-Kapteyn.

– 2SLS/IV estimation with cross-section and period fixed or randomeffects.

– Estimation with AR errors using nonlinear least squares on atransformed specification

– Generalized least squares, generalized 2SLS/IV estimation, GMMestimation allowing for cross-section or period heteroskedastic andcorrelated specifications.

– Linear dynamic panel data estimation using first differences ororthogonal deviations with period-specific predeterminedinstruments (Arellano-Bond).

– Panel serial correlation tests (Arellano-Bond).

– Robust standard error calculations include seven types of robustWhite and Panel-corrected standard errors (PCSE).

– Testing of coefficient restrictions, omitted and redundantvariables, Hausman test for correlated random effects.

– Panel unit root tests: Levin-Lin-Chu, Breitung, Im-Pesaran-Shin,Fisher-type tests using ADF and PP tests (Maddala-Wu, Choi),Hadri.

– Panel cointegration estimation: Fully Modified OLS (FMOLS,Pedroni 2000) or Dynamic Ordinary Least Squares (DOLS, Kao andChaing 2000, Mark and Sul 2003).

– Pooled Mean Group (PMG) estimation.

Generalized Linear Models:

– Normal, Poisson, Binomial, Negative Binomial, Gamma, InverseGaussian, Exponential Mena, Power Mean, Binomial Squaredfamilies.

– Identity, log, log-complement, logit, probit, log-log,complimentary log-log, inverse, power, power odds ratio, Box-Cox,Box-Cox odds ratio link functions.

– Prior variance and frequency weighting.

– Fixed, Pearson Chi-Sq, deviance, and user-specified dispersionspecifications. Support for QML estimation and testing.

– Quadratic Hill Climbing, Newton-Raphson, IRLS – Fisher Scoring,and BHHH estimation algorithms.

– Ordinary coefficient covariances computed using expected orobserved Hessian or the outer product of the gradients. Robustcovariance estimates using GLM, HAC, or Huber/White methods.

Single Equation Cointegrating Regression:

– Support for three fully efficient estimation methods, FullyModified OLS (Phillips and Hansen 1992), Canonical CointegratingRegression (Park 1992), and Dynamic OLS (Saikkonen 1992, Stock andWatson 1993

– Engle and Granger (1987) and Phillips and Ouliaris (1990)residual-based tests, Hansen’s (1992b) instability test, and Park’s(1992) added variables test.

– Flexible specification of the trend and deterministic regressorsin the equation and cointegrating regressors specification.

– Fully featured estimation of long-run variances for FMOLS andCCR.

– Automatic or fixed lag selection for DOLS lags and leads and forlong-run variance whitening regression.

– Rescaled OLS and robust standard error calculations for DOLS.

User-specified Maximum Likelihood:

– Use standard EViews series expressions to describe the loglikelihood contributions.

– Examples for multinomial and conditional logit, Box-Coxtransformation models, disequilibrium switching models, probitmodels with heteroskedastic errors, nested logit, Heckman sampleselection, and Weibull hazard models.

Systems of Equations:

Basic:

– Linear and nonlinear estimation.

– Least squares, 2SLS, equation weighted estimation, SeeminglyUnrelated Regression, and Three-Stage Least Squares.

– GMM with White and HAC weighting matrices.

– AR estimation using nonlinear least squares on a transformedspecification.

– Full Information Maximum Likelihood (FIML).

VAR/VEC:

– Estimate structural factorizations in VARs by imposing short- orlong-run restrictions, or both.

– Bayesian VARs.

– Impulse response functions in various tabular and graphicalformats with standard errors calculated analytically or by MonteCarlo methods.

– Impulse response shocks computed from Cholesky factorization,one-unit or one-standard deviation residuals (ignoringcorrelations), generalized impulses, structural factorization, or auser-specified vector/matrix form.

– Historical decomposition of standard VAR models.

– Impose and test linear restrictions on the cointegratingrelations and/or adjustment coefficients in VEC models.

– View or generate cointegrating relations from estimated VECmodels.

– Extensive diagnostics including: Granger causality tests, jointlag exclusion tests, lag length criteria evaluation, correlograms,autocorrelation, normality and heteroskedasticity testing,cointegration testing, other multivariate diagnostics.

Multivariate ARCH:

– Conditional Constant Correlation (p,q), Diagonal VECH (p,q),Diagonal BEKK (p,q), with asymmetric terms.

– Extensive parameterization choice for the Diagonal VECH’scoefficient matrix.

– Exogenous variables allowed in the mean and variance equations;nonlinear and AR terms allowed in the mean equations.

– Bollerslev-Wooldridge robust standard errors.

– Normal or Student’s t multivariate error distribution

– A choice of analytic or (fast or slow) numeric derivatives.(Analytics derivatives not available for some complex models.)

– Generate covariance, variance, or correlation in various tabularand graphical formats from estimated ARCH models.

State Space:

– Kalman filter algorithm for estimating user-specified single- andmultiequation structural models.

– Exogenous variables in the state equation and fully parameterizedvariance specifications.

– Generate one-step ahead, filtered, or smoothed signals, states,and errors.

– Examples include time-varying parameter, multivariate ARMA, andquasilikelihood stochastic volatility models.

Testing and Evaluation:

– Actual, fitted, residual plots.

– Wald tests for linear and nonlinear coefficient restrictions;confidence ellipses showing the joint confidence region of any twofunctions of estimated parameters.

– Other coefficient diagnostics: standardized coefficients andcoefficient elasticities, confidence intervals, variance inflationfactors, coefficient variance decompositions.

– Omitted and redundant variables LR tests, residual and squaredresidual correlograms and Q-statistics, residual serial correlationand ARCH LM tests.

– White, Breusch-Pagan, Godfrey, Harvey and Glejserheteroskedasticity tests.

– Stability diagnostics: Chow breakpoint and forecast tests,Quandt-Andrews unknown breakpoint test, Bai-Perron breakpointtests, Ramsey RESET tests, OLS recursive estimation, influencestatistics, leverage plots.

– ARMA equation diagnostics: graphs or tables of the inverse rootsof the AR and/or MA characteristic polynomial, compare thetheoretical (estimated) autocorrelation pattern with the actualcorrelation pattern for the structural residuals, display the ARMAimpulse response to an innovation shock and the ARMA frequencyspectrum.

– Easily save results (coefficients, coefficient covariancematrices, residuals, gradients, etc.) to EViews objects for furtheranalysis.

See also Estimation and Systems of Equations for additionalspecialized testing procedures.

Forecasting and Simulation:

– In- or out-of-sample static or dynamic forecasting from estimatedequation objects with calculation of the standard error of theforecast.

– Forecast graphs and in-sample forecast evaluation: RMSE, MAE,MAPE, Theil Inequality Coefficient and proportions

– State-of-the-art model building tools for multiple equationforecasting and multivariate simulation.

– Model equations may be entered in text or as links for automaticupdating on re-estimation.

– Display dependency structure or endogenous and exogenousvariables of your equations.

– Gauss-Seidel, Broyden and Newton model solvers for non-stochasticand stochastic simulation. Non-stochastic forward solution solvefor model consistent expectations. Stochasitc simulation can usebootstrapped residuals.

– Solve control problems so that endogenous variable achieves auser-specified target.

– Sophisticated equation normalization, add factor and overridesupport.

– Manage and compare multiple solution scenarios involving varioussets of assumptions.

– Built-in model views and procedures display simulation results ingraphical or tabular form.

Graphs and Tables:

– Line, dot plot, area, bar, spike, seasonal, pie, xy-line,scatterplots, bubbleplots, boxplots, error bar,high-low-open-close, and area band.

– Powerful, easy-to-use categorical and summary graphs.

– Auto-updating graphs which update as underlying data change.

– Observation info and value display when you hover the cursor overa point in the graph.

– Histograms, average shifted historgrams, frequency polyons, edgefrequency polygons, boxplots, kernel density, fitted theoreticaldistributions, boxplots, CDF, survivor, quantile,quantile-quantile.

– Scatterplots with any combination parametric and nonparametrickernel (Nadaraya-Watson, local linear, local polynomial) andnearest neighbor (LOWESS) regression lines, or confidenceellipses.

– Interactive point-and-click or command-based customization.

– Extensive customization of graph background, frame, legends,axes, scaling, lines, symbols, text, shading, fading, with improvedgraph template features.

– Table customization with control over cell font face, size, andcolor, cell background color and borders, merging, andannotation.

– Copy-and-paste graphs into other Windows applications, or savegraphs as Windows regular or enhanced metafiles, encapsulatedPostScript files, bitmaps, GIFs, PNGs or JPGs.

– Copy-and-paste tables to another application or save to an RTF,HTML, LaTeX, PDF, or text file.

– Manage graphs and tables together in a spool object that lets youdisplay multiple results and analyses in one object

Commands and Programming:

– Object-oriented command language provides access to menuitems.

– Batch execution of commands in program files.

– Looping and condition branching, subroutine, and macroprocessing.

– String and string vector objects for string processing. Extensivelibrary of string and string list functions.

– Extensive matrix support: matrix manipulation, multiplication,inversion, Kronecker products, eigenvalue solution, and singularvalue decomposition.

External Interface and Add-Ins:

– EViews COM automation server support so that external programs orscripts can launch or control EViews, transfer data, and executeEViews commands.

– EViews offers COM Automation client support application forMATLAB® and R so that EViews may be used to launch or control theapplication, transfer data, or execute commands.

– The EViews Microsoft Excel® Add-in offers a simple interface forfetching and linking from within Microsoft Excel® (2000 and later)to series and matrix objects stored in EViews workfiles anddatabases.

– The EViews Add-ins infrastructure offers seamless access touser-defined programs using the standard EViews command, menu, andobject interface.

– Download and install predefined Add-ins from the EViewswebsite.

Installer Size: 237 + 246 +131 + 134 MB

Download Links : EViews v10.0 Build October 19, 2017 x86/x64 Full Crack